News

-

Sierra Leone parliament frowns at Sierra Rutile deal

30Mar2024By Saio Marrah

Parliamentarians, who recently embarked on oversight visits to different mining companies across the country, have expressed their dissatisfaction over attempts by Marampa mining company to buy over Sierra Rutile Mines.

-

Guinea to extradite alleged Sierra Leonean coup plotter

30Mar2024By Sorie Ibrhaim Fofanah

A Government press release dated 25 March 2024 has stated that Abubakarr Boxx Konteh is to be extradited to Sierra Leone for his alleged role in last year’s failed coup.

BottomLine

Business

-

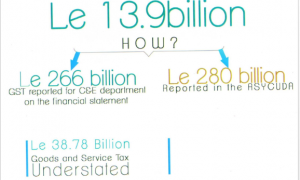

Reports slam Sierra Leone tax authority over Le 17.4 billion in revenue losses

12Mar2017By Tanu Jalloh

Budget Advocacy Network (BAN), supported by National Endowment for Democracy, has released its analyses of Sierra Leone’s Audit Service reports on the activities of the country’s National Revenue Authority (NRA) for 2011 and 2014.

-

‘Made in Sierra Leone’

10Mar2017By Tanu Jalloh

Very soon Sierra Leone will have, as a policy directive or legislation, some incentives to boost local production and introduce trade regulations that encourage consumers to patronise goods manufactured in country - ‘Made in Salone’.

-

Risks amidst strong mining outlook for Sierra Leone

16Jan2017By Tanu Jalloh

In its latest risk and industry analysis BMI Research, based in London, has revealed that Sierra Leone has further cemented the West African region’s strong mining outlook after Shandong’s planned investment of $700 million.

It however warned of a danger that ore prices could moderate by end of this year or early next year which could even put the whole investment at risk, possibly a blow that could weaken “an economy that has only recently started recovering from the Ebola crisis.”

-

Sierra Leone introduces huge cuts to tackle economic slowdown

03Oct2016By Tanu Jalloh

Sierra Leone on Monday introduced tough new measures including massive cuts in a bid to tackle the current economic crisis in the country.

The announcement, which followed an emergency cabinet meeting, also proposed stern measures that will force “all business outfits to pay outstanding arrears of taxes within 30 days”.