By Mabinty M. Kamara

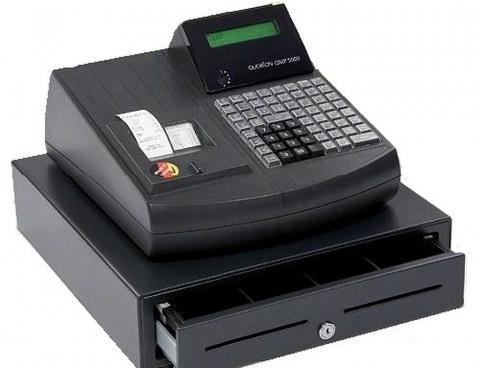

The National Revenue Authority (NRA) is taking its digitalization drive to a new level with its planned introduction of the Electronic Cash Register System (ECRS) for businesses operating in the country.

Officials said the ECRS, one of several innovations being introduced by the NRA, is meant to encourage businesses to pay taxes due to government and they are calling on taxpayers to embrace the new system that is expected to fully operational next year.

The ECRS is designed to make the tax system accessible and transparent. It is set up so that when a customer pays for any good or service, the machine calculates the real cost of the good or service as well as the tax for same.

Revenue officer at the NRA, Mohamed Konneh, described the proposed system as a “laudable venture” that’s part of wider reforms in the Authority which are geared towards easing the burden on both tax collectors and taxpayer. He said the system will also reduce human interface in tax collection, thereby reducing the chance corruption.

“We want to move away from the manual system to an automated system which is the need for these reforms. These reforms are coming in to ease the burden on both sides and mostly for the taxpayers,” he said.

“The ECRS, when it shall have been implemented, will also help with compliance and has lots of advantages for the taxpayers, including record keeping for about ten years.”

The plan to introduce the ECRS was revealed at a sensitization workshop on Tuesday designed to educate taxpayers, including businesses like private schools, shops, clearing and forwarding agencies and journalists on the new digital systems the Authority is putting in place.

The ECRS machines are designed so that they can be used even without internet connection. The data is saved and then sent to the NRA server immediately when internet is available.

Konneh said that the system will also help businesspeople to take proper stock of their goods and sales and that it would also be set up in a way that prevents the data from being deleted.

A pilot phase of the ECRS is ready to start in January.

Konneh said with the new system in place, citizens must help the government to collect its revenue by demanding for their receipts whenever they buy products.

“The Electronic Cash Register is unique, and it will help generate more revenue for the government that can be used to develop Sierra Leone. Whenever you purchase anything, ensure [that] you collect your receipt because by failing to do that you are making a businessman rich, whiles you are making the government bankrupt,” he said.

The taxman said it is also planning to introduce another system called the Integrated Tax Administration System. Assistant Commissioner at the NRA, Thelma Conteh, said this system will help harmonize the entire NRA tax system.

“This is to let the NRA system speak the same language and to minimize the human interface between the tax collector and the taxpayers which normally causes discrepancies in the taxes collected. There have been lots of reforms to help keep the record clear and transparent to make the tax process simple and friendly,” she said.

Despite always meeting its annual target, NRA has still been robbed in the past by businesses that evade taxes. The digitalization of tax system is therefore aimed at preventing that leakage.

Copyright © 2019 Politico Online